AvaTax

Avalara AvaTax is a cloud-based solution automating transaction tax calculations and the tax filing process. Avalara provides real-time tax calculation using tax content from more than 12,000 US taxing jurisdictions and over 200 countries, insuring your transaction tax is calculated based on the most current tax rules.

Prerequisites

- You must have a fully functioning Avalara account.

- You must configure the Zenskar's Avalara AvaTax connector.

Note

Discount can be applied at the level of a product and\or at the level of the contract.

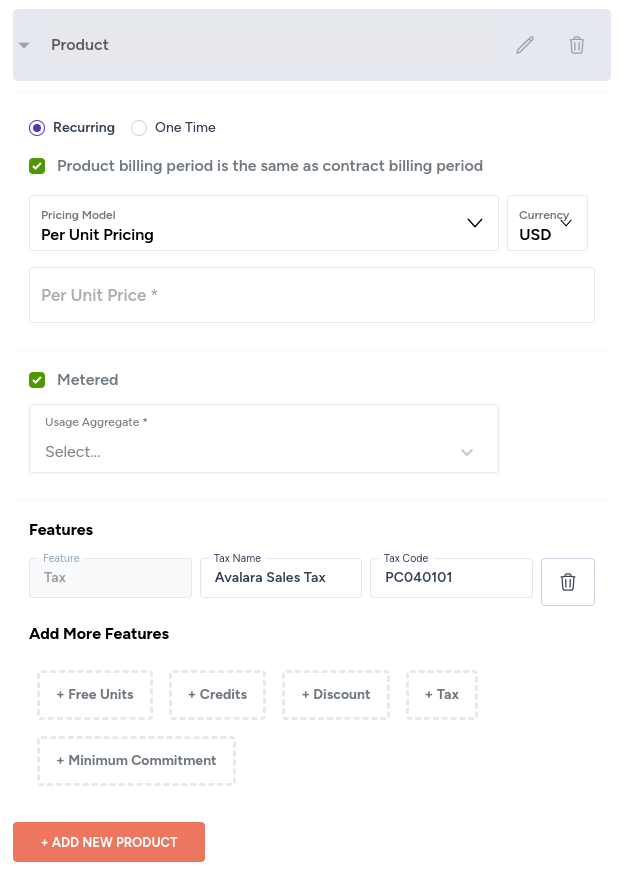

Fig. 1: Avalara AvaTax at the product level.

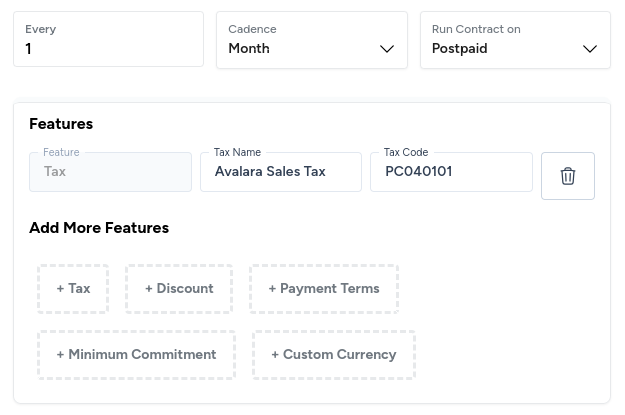

Fig. 2: Avalara AvaTax at the contract level

Anatomy of an Avalara tax code

Most Avalara tax codes are made up of eight characters: two letters to start and six numbers at the end.

- The first letter indicates the tax code type (P for products, D for digital, Fr for freight, S for services, O for other).

- The second letter indicates the tax code category (for example, C for clothing).

- The six numbers indicate subcategories under the tax code category.

Examples

- PC040101: Aprons

- PC040105: Bandanas

- PC040111: Coats and jackets

Avalara tax code search tool

Avalara uses tax codes to identify products that have specific tax rates depending on where they are taxed. Using Avalara tax codes makes tax calculation easy for your company because Avalara keeps track of rate changes for products that have tax codes.

Avalara tax code search tool helps you discover the appropriate tax codes.

Updated about 2 months ago