Revenue Recognition Reimagined With AI

Share your contracts and let Zenskar AI automatically derive ASC 606 & IFRS 15 compliant performance obligations, revenue schedules, and close books 75% faster for any subscriptions, or usage-based pricing.

Trusted by fast-growing companies

Beyond traditional revenue recognition

Transform your finance operations with Zenskar’s AI-powered order-to-cash automation.

Ditch the Spreadsheets

Just input contract terms and usage data - Let Zenskar's AI handle all revenue recognition automatically.

Built for modern pricing

Recognize revenue for any pricing - from simple subscriptions to complex usage-based pricing.

Flexible than legacy systems

Unlike legacy tools, Zenskar handles any recognition method while keeping your billing exactly as is.

Faster close, zero errors

Automatic journal entries flow directly to your ERP with built-in audit trails.

See What's Included in Zenskar RevRec

Unlike legacy tools, Zenskar decouples revenue recognition from billing, letting you manage performance obligations independent of invoicing terms.

Say goodbye to formula-fried spreadsheets

Move away from manual calculations and automate the revenue side of accounting with AI-powered order-to-cash automation.

- Extract POBs from contracts with AI: Automatically derive performance obligations from complex contracts.

- Automate journal entries: Create balanced entries for unbilled revenue, accounts receivable, and expenses based on contract terms.

- Export audit-ready reports: View and export debit/credit journal entries, balance sheets, and P&L statements with a single click.

- Sync with your GL: Sync balanced journal entries to your ERP/general ledger in real-time.

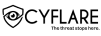

Configure recognition rules for your business

Set up revenue recognition rules and apply these to individual contracts or your customer base.

- Recognize revenue as obligations are met: Align revenue recognition with contract-specific milestones.

- Flexible revenue schedules: Create automatic deferred, unbilled, and unearned revenue schedules, and adjust without disrupting existing schedules.

- Multiple recognition methods: Set up straight-line, exact days, milestones, or usage-based approaches to match your revenue policies.

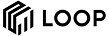

Automate SSP-based revenue allocation

Easily apply Standalone Selling Price (SSP) to performance obligations, and maintain compliance with ASC 606/IFRS 15 fair value requirements.

- Create and update SSPs effortlessly with flexible single price or range configurations for any product type

- Adjust SSPs and weightage mid-contract without disrupting ongoing revenue recognition

- Automate transaction price calculation across contracts and performance obligations

Stay audit-ready all the time

Generate compliant balance sheets, P&L statements, and revenue reports that keep your auditors happy.

- Complete audit trail: Create journal entries with detailed timestamps. Review and post historical entries while maintaining intact locked periods.

- Multi-entity access: Manage separate ledgers for each legal entity and jurisdiction from a single login.

- Contract amendments: Recalculate revenue (future and past) for contract modifications with manual override options.

Bookkeeping beyond just revenue recognition

Say goodbye to hours of pulling data from multiple sources to reconciling payments and taxes. Generate automated journal entries for:

- Receivables from payment gateways

- Gateway fee (e.g., Stripe fees)

- Cash (Funds deposited into your account)

- Sales tax liabilities across multiple jurisdictions and tax rates

Make better decisions with real-time reports

Give your team the tools to drive strategic financial decisions with real-time financial insights.

- Create custom reports: Adjust reporting periods and apply advanced filters to focus on the data that matters to you.

- Provide stakeholder visibility: Share revenue data with key stakeholders, including product teams, C-suite, and board members.

Why modern finance teams choose Zenskar

Revenue recognition doesn't have to be fragmented across multiple tools.

Spreadsheets

Error-prone calculations

Manual updates required

No audit trails

Limited compliance

Time-consuming close

Legacy RevRec Tools

Tied to billing cycles

Fixed recognition rules

Limited pricing model support

Manual workaround needed

Basic ASC 606 support

Zenskar RevRec

Decoupled from billing

Support any pricing

Flexible recognition rules

Automated journal entry and ERP sync

Full ASC 606 & IFRS 15 compliance

Proven impact, delighted customers

From faster closes to reduced manual work — see how Zenskar empowers finance teams to move faster, smarter, and with confidence.

Go live in weeks, not months

We’re with you every step of the way - from pilot to post-implementation. See immediate ROI from day one.

Test Zenskar’s complete feature set in sandbox. No credit card, no risk.

Migrate and implement Zenskar in as little as a few hours to few weeks.

We work as an extension of your team. Get white-glove support via Slack, Zoom, and email at no extra cost.

Enterprise-grade security

We uphold the highest standards of data integrity and security, so you stay secure and compliant without worry.

Explore more features

Frequently asked questions

Can’t find what you are looking for? Find more about the platform in our documentation or write to us with specific questions here.

Zenskar is the most flexible saas revenue recognition platform in the Within Zenskar, billing is decoupled from revenue recognition. This means revenue performance obligations are independent of invoiced items, enabling flexibility in automation rules and adjustable revenue schedules.

Our rev rec software automatically implements the 5-step revenue recognition method required by ASC 606 & IFRS 15 standards. Simply provide your contract and usage data, and Zenskar creates compliant performance obligations, revenue schedules, and posts journal entries to your revenue sub-ledger and ERP.

Yes, Zenskar's revenue recognition includes a proper revenue sub-ledger that houses detailed journal entries for deferred revenue, collections, credit notes, refunds, adjustments, sales tax payables, payment gateway fees, and more.

Yes, Zenskar's revenue recognition automation follows ASC 606 & IFRS 15 guidelines to accurately recognize revenue on an accrual basis as per the 5-step model and performance obligations defined in your contracts. This allows you to record revenue as it is earned rather than when cash is received.

Zenskar’s implementation is based on your use case and needs. It typically takes 2–4 weeks for small teams, 4–10 weeks for medium businesses and 8–16 weeks for enterprises. This includes migration, integration, and going live. We provide 24 x 7 support via email, Slack, and Zoom to ensure a smooth transition.